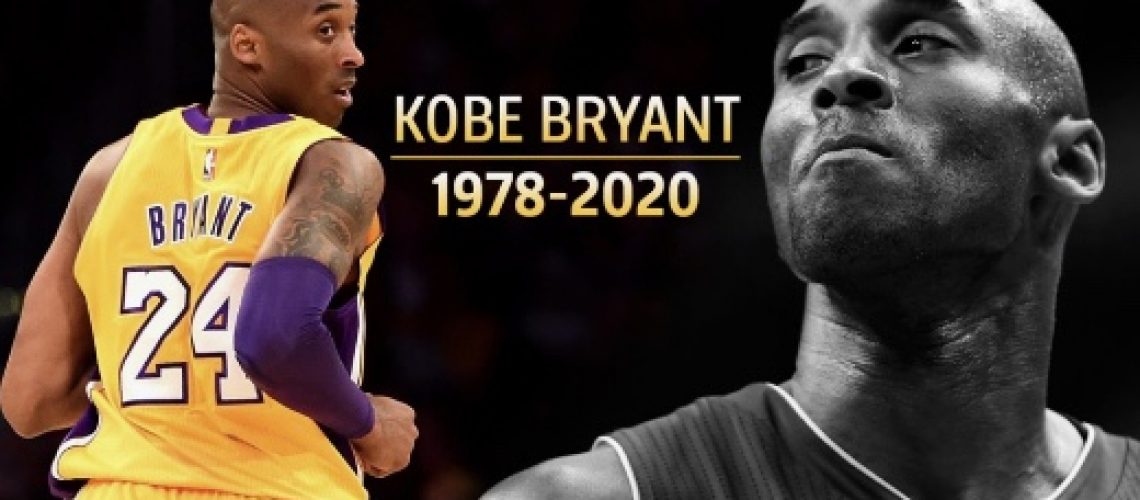

Last Sunday we learned of the death of Kobe Bryant. Kobe Bryant’s legacy is heavy on the minds of people around the world. Kobe inspired people around the world through his acts on and off the court.

Like all of us, Kobe made some decisions he regret however there is one thing about him that everyone can agree was positive, his Mamba mentality.

What is Mamba Mentality actually? it’s all about focusing on the process and trusting in the hard work when it matters most. It’s the ultimate mantra for the competitive spirit.

Kobe had a killer mentality. The mamba movement has inspired more than just pro athletes. Fans everywhere are now using the phrase as motivation to keep going, to keep pushing, and to keep fighting.

Imagine if we had that same focus about our own personal finances. Many of us have played the game Monopoly. You don’t win in Monopoly by simply going around the board and collecting money when you pass GO!

In fact you lose that way. You only win when you invest your money. It’s the same thing with life. You must invest if you’re going to win Financial Freedom.

In September of last of last year when Kobe visited Wallstreet, he was asked how does he want his legacy to be remembered in 20 years. He responded: My legacy should be about investing. Championships come and go. You need something that lasts generations.

So now Kobe has departed and he can’t get his earthly life back his family is left to mourn and prepare for his funeral services.

Death always reminds us that our time on earth is limited. It’s already difficult to mourn a loss but it’s much easier if our financial affairs are in place for our family to handle our final arrangements.

Benjamin Franklin famous quote states, “In this world nothing can be said to be certain, except death and taxes.” We don’t have pre-determined date of our death however do you have a financial plan set in place for your family when you pass away?

Do you have life insurance or enough? Do you have a will or trust in place? If you were to die tomorrow, does your spouse, child, or sibling(s) know where to find information on your life insurance, banking and investment accounts, funeral instructions and passwords?

Every household needs a “legacy drawer.” The drawer should be somewhere in the house and contain everything your spouse or family needs to know if you die. Anything that has to do with your financial life should in in that drawer.

Having our financial act together is a tool God intended for us to have. Why leave the burden on your family when they are grieving your loss. Having a plan in place is one way to strongly say, I love you, to your loved ones.

May Kobe legacy continue to live forever and the families of the the other lives lost last Sunday be comforted.

Instead of saying, “it’s generational,” generate some solutions that’ll move you and your loved ones toward new path – Freedom and Security!